Council Tax Reduction letter explained

This short video may help you to understand your Council Tax Reduction letter. We have answered some other common questions below the video. This video is also available in Urdu and Slovak.

Why have I received a Council Tax Reduction Calculation Summary?

What is a Council Tax Reduction Calculation Summary?

How much Council Tax do I have to pay?

How is my Council Tax Reduction paid?

What are non-dependant deductions?

How can I find out more about Council Tax?

Why have I received a Council Tax Reduction Calculation Summary?

You will receive a letter in March of each year to let you know how much Council Tax Reduction you will get from April.

You may also receive a Council Tax Reduction Calculation Summary at other times if there has been a change in your circumstances.

What is a Council Tax Reduction Calculation Summary?

It is a letter telling you how much financial help we will give you to reduce your Council Tax bill.

How much Council Tax do I have to pay?

Your Council Tax Reduction letter does not tell you how much Council Tax you have to pay. To find this out you need to look at your Council Tax bill, which is a separate letter.

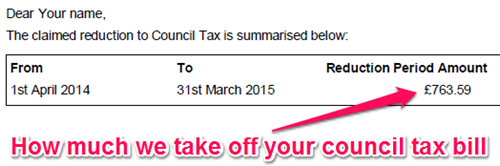

The Council Tax Reduction letter tells you how much money will be taken off you bill. This is shown in the summary box near the top of your letter.

How is my Council Tax Reduction paid?

Council Tax Reduction will be taken directly off your Council Tax account to reduce your bill.

What are non-dependant deductions?

A non-dependant is someone over 18 who normally lives with you but doesn’t pay rent. This could be a friend or member of the family such as grown up children or parents living with you.

We take a fixed amount from your housing benefit and/or give you a smaller Council Tax reduction based on the weekly income, before tax, of your non-dependants.

We make these deductions whether the non-dependant contributes to your household or not.

What is an Applicable Amount?

An applicable amount is the minimum weekly amount of money the Government says that you and your family need to have a basic standard of living. The applicable amount will depend on your age, circumstances and who is in your household.

What is disregarded income?

This is part of your weekly income that we do not count when we are calculating your Housing Benefit and/or Council Tax Reduction.

How can I find out more about Council Tax?

We have answered some common questions about council tax on another page.