Paying for non residential care

Community Care contributions from October 2017. This page explains how charging works for non-residential social care in Bradford. This is also known as Community Care

Financially assessed contributions

How much you pay towards your care will be based on your income and capital, against which deductions will be made for allowable expenditure.

If the information required to carry out the financial assessment is not made available then you will pay the full cost of your care.

The contributions calculation is explained in more detail below.

Chargeable services

Examples of services charged for include:

- Day care (unless provided as part of a package of residential care)

- Personal care

- Outreach support

- Supported living services

- Time Out

- Extra Care Housing

You will not have to pay a charge if:

- You are suffering from Creutzfeldt Jakob Disease

- You are in receipt of 100% Continuing Healthcare Funding

- You are receiving aftercare under Section 117 of the Mental Health Act

Financial assessment

If you have savings or investments (capital) over the current national threshold of £23,250 you will be asked to pay the full Cost of Care. If your capital is below £23,250 we will need to see full details of your income and capital. This includes for example, building society passbooks, bank statements, share certificates and other income or capital documents.

The Financial Assessment also takes account of some property-related household expenses and certain extra expenses you may have because you are disabled. These are called disability-related expenses.

This will help us to calculate your charge and identify any other benefits that you should be claiming.

When the Financial Assessment has been completed, you will be sent a statement which explains how your charge has been calculated and you will receive an invoice.

How your charge is calculated

Your payment will either be your Assessment Income or Cost of Care which ever is the least.

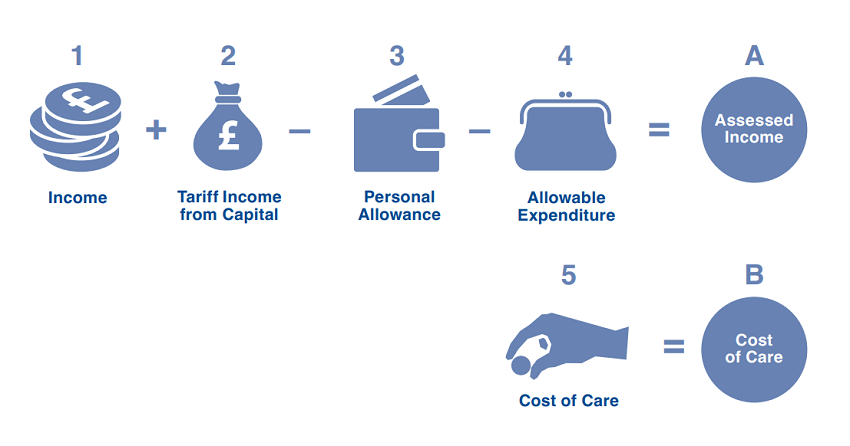

The diagram below shows how each one is worked out:

Income + Tariff income from capital - personal allowance - allowable expenditure = assessed income (A)

Cost of care (B)

Your charge per week will be A or B whichever is the least.

A: Assessed Income

Your Assessed Income is the figure calculated through your Financial Assessment. This is what you have been assessed as being able to afford.

If this Assessed Income is less than or equal to the Cost of Care, this is what you will pay.

1. Income

Income from all sources will be considered in your Financial Assessment.

Income includes, but is not limited to:

- State benefits

- Employment and Support Allowance

- Job Seeker's Allowance

- Disability benefits

- Pension Credit

- Occupational and private pensions

- Any other income

Income does not include:

- Earnings from employment

- Charitable income

- Winter fuel and cold weather payments

- Statutory sick pay, statutory adoption pay and statutory maternity pay or allowance

- The mobility component of disability living allowance or personal independence payment

- Tax credit

- Maintenance payments specifically relating to a child

- War pensions

- Guaranteed income payments (GIPs) paid under the armed forces compensation scheme (AFCS)

2. Tariff income from capital

If you have capital above £14,250 but below £23,250, we will work out an amount for tariff income. This is calculated at a rate of £1 a week for every £250 (or part of £250) of your savings over £14,250.

Your home

The value of your home will not be taken into account as capital.

The value of any property or land owned by you other than your main residence (your home) may be regarded as Capital to be used in a Financial Assessment.

There are some circumstances under which certain property or land may be disregarded.

The rules relating to property are complex, but the Financial Assessment Team will discuss this with you according to your individual circumstances.

Disposal of assets

If there is evidence to suggest that you and/ or your family have spent, transferred or otherwise deprived yourself of the capital available in order to reduce the payment of charges, this will be taken seriously and we will take this capital into account as if you still own it.

3. Personal Allowance

Your Personal Allowance is calculated using rates set centrally by government. This is also known as minimum income guarantee.

4. Allowance Expenditure

Property-related household expenditure:

The expenditure we will take into account is in respect of your main home only, and may include the following:

- Council tax (net of Council Tax Reduction)

- Rent (net of Housing Benefits and any ineligible service charges)

- Mortgage payments (unless paid through Income Support or Pension Credit or if you receive payments under a Mortgage Protection Scheme)

- Ground Rent/ Service Charges

Disability related expenditure

Disability related expenditure will be considered where the expenditure is required to aid independent living and where a service user has little or no choice but to incur the expense specifically due to their disability/ illness. Your support plan that sets our how your assessed adult social care needs are to be met will be used to consider whether disability related expenditure applies.

B - Cost of care

The cost of care will vary depending upon the services you receive.

What if I do not disclose my financial information?

You will pay the full cost of care.

Self-funding your care

- A self-funder is someone who is paying for the full cost of their care and support. This is most common where you have savings or investments adding up to over £23,250. This figure is set every year by the Government.

- If you don’t provide the information we need to complete a financial assessment we will consider you to be a self-funder or if you do not have eligible care needs under the Care Act, you will have to pay the full cost of care you have arranged.

- If you are a self-funder, you are entitled to a free assessment of your care needs. After this, the council can arrange your non-residential care and support for you. Currently, the council does not charge for arranging non-residential care for self-funders, however this service is under review and will become chargeable at some point in the future.

- Alternatively, you may choose to enter into private arrangements with care providers to arrange your care.

- While paying for your care, the amount of your savings and investments will reduce. You should let us know when this amount gets close to the capital limit (£23,250) by contacting the Independent Advice Hub on 01274 434500.

Independent advice for self-funders

- Paying for care can be complex, particularly if you are funding your own care. The council can't provide individual financial advice directly, but we do recommend that you consider seeking independent financial advice as early as possible. We will assist you to understand how to access independent financial advice. We recommend that you check that any financial advisor you choose to use is registered with the Financial Conduct Authority (FCA).

- You may also wish to take legal advice from a solicitor to assist you with any proposed arrangements. Should you wish to do so, the Law Society’s Find a Solicitor service might be helpful.

Can someone tell me how much my charge might be before I start receiving support?

Once we have details of your finances we can give you an indication of your Assessed Income. This will not take into account the cost of your care at this point but will show us what you can afford to contribute.

What if my provider fails to deliver my services?

Please let us know if your provider has failed to deliver your service. We will discuss this with the provider and we will review your care charges account. Please note that you may not always see a reduction in your weekly charge as this is dependent upon your financial assessment, which determines your weekly charge and the level of services that you receive.

If I reduce my care package will my charge reduce?

For most people reducing your package will not reduce the charge you are paying. This is because your charge will be lower than the cost of your care package.

Your care package is based on your care need assessment and the services that are required to meet your assessed adult social care needs, therefore you would need to discuss with your social care worker any reason for reducing your care package.

Who to contact

For queries relating to the Financial Assessment process contact the Financial Assessment Team by email [email protected] or by telephone on 01274 437987 or 01274 434961.

For information about your invoice contact the Contributions Team by email [email protected] or on 01274 437975 or 01535 618109.