Council Tax bill explained

Your Council Tax bill will show details such as your current method of payment, the amount of each instalment and the due date by which it must reach us.

More information about Council Tax can be be found on our Council Tax bills page.

You can also find more information about Council Tax bands and amounts online.

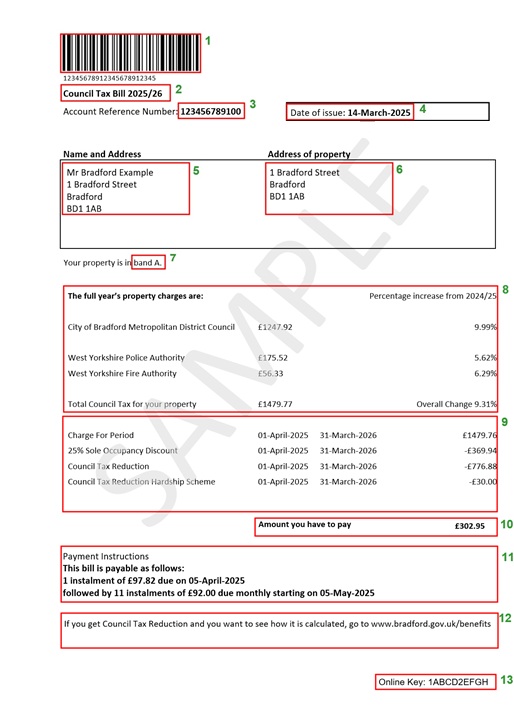

There is an explanation of your Council Tax bill below. Please note that this is just a sample bill and doesn't show correct figures or percentages.

- You can use this barcode if you want to pay your bill in cash by PayPoint.

- This is the financial year that your bill relates to.

- Your Council Tax Reference Number. To help us deal with any queries quickly, always quote this number when you contact us.

- Date the Council Tax bill was issued.

- The person(s) liable for payment of the bill and their contact address – where the bill will be sent to.

- This is the property address that the Council Tax bill relates to.

- This is the valuation band your property is in. The amount of Council Tax you pay is directly related to this.

- Charges for your bill – will be broken down between Council Tax, Police, Fire, and any local precept. This area also shows the percentage that this year's bill has increased from last year.

- This shows the period of liability this bill relates to and includes any reductions that have been awarded to your account, such as:

- Single Person Discount - a 25 % discount for households with only one adult. If there is more than 1 adult in the house you will need to cancel your Single Person Discount.

- Council Tax Reduction - a means tested reduction in your bill based on your household income

- Disabled Band Reduction – a reduction if the property has an adaptation to meet the needs of a disabled person

- Council Tax Reduction Hardship Scheme – a one-off reduction in Council Tax of £30 to help working-aged households with the extra increase in Council Tax for 2025-26

For a full list, please see our ways to reduce your bill page.

- This shows the amount you need to pay.

- This is the current payment instruction of your bill. You need to pay the amounts on the dates shown here.

- If you get Council Tax Reduction, we tell you in this part of the bill where you can find information about how your benefit is calculated

- Online key - you will need this, as well as your Council Tax reference (see number 3) to access your online account, known as MyInfo.